Revised IPO Financial Thresholds and Underwriting Requirements for 2026

With its decision dated 30 December 2025 and numbered 58/2461, published in the Capital Markets Board Bulletin dated 31 December 2025 and numbered 2025/68 (“CMB Decision”), the Capital Markets Board of Turkey (“CMB”) has increased the financial criteria applicable to companies conducting an initial public offering for the first time (“IPO”).

1. Minimum Capital Requirement for Transition to the Authorized Capital System Increased

Pursuant to the CMB Decision, in accordance with Article 5 of the Communiqué on the Authorized Capital System numbered II-18.1, the minimum capital amount required for companies transitioning to the authorized capital system has been set at TRY 200,000,000 for 2026.

2. Financial Criteria Regarding Total Assets and Net Sales Revenue Increased

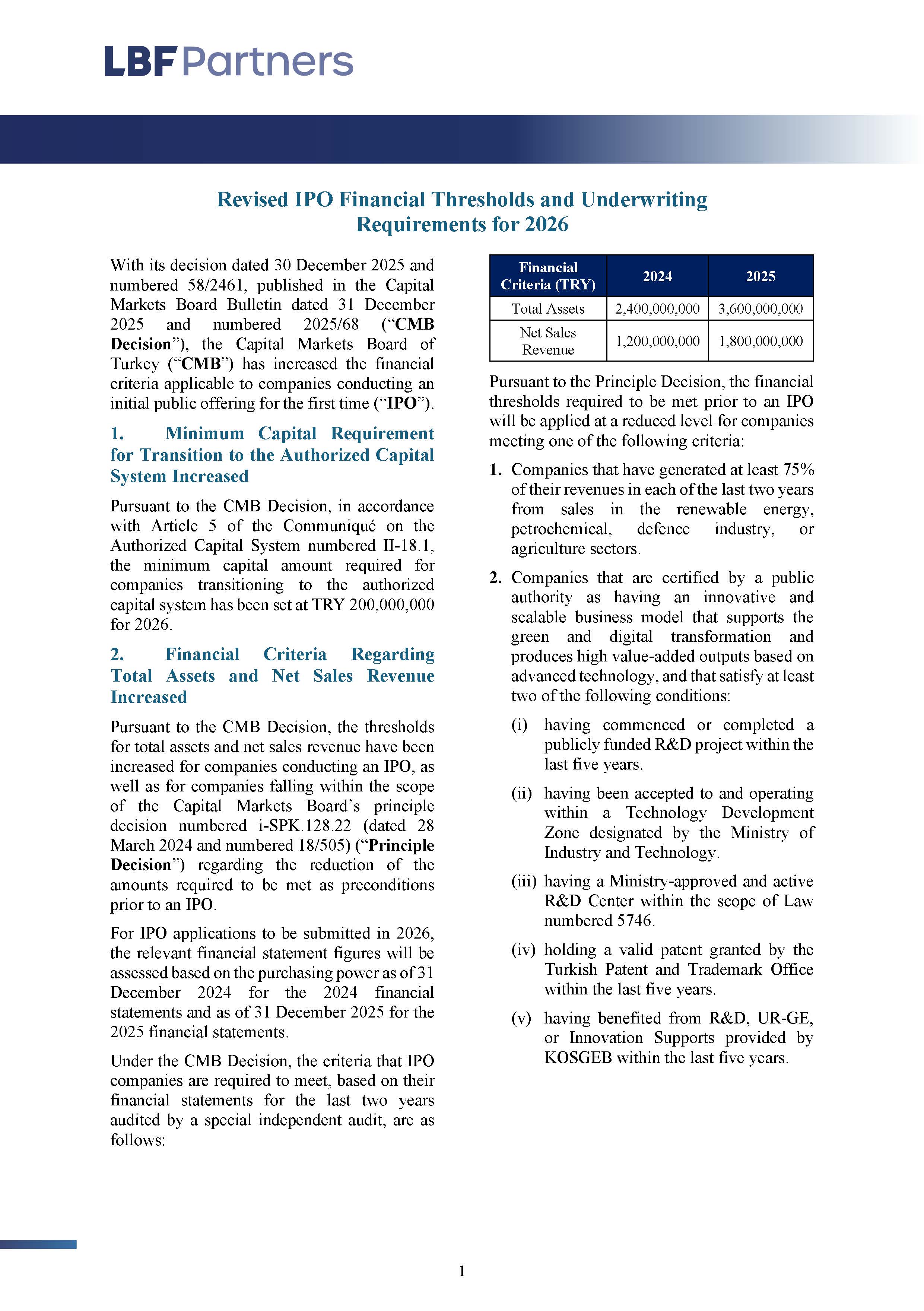

Pursuant to the CMB Decision, the thresholds for total assets and net sales revenue have been increased for companies conducting an IPO, as well as for companies falling within the scope of the Capital Markets Board’s principle decision numbered i-SPK.128.22 (dated 28 March 2024 and numbered 18/505) (“Principle Decision”) regarding the reduction of the amounts required to be met as preconditions prior to an IPO.

For IPO applications to be submitted in 2026, the relevant financial statement figures will be assessed based on the purchasing power as of 31 December 2024 for the 2024 financial statements and as of 31 December 2025 for the 2025 financial statements.

Under the CMB Decision, the criteria that IPO companies are required to meet, based on their financial statements for the last two years audited by a special independent audit, are as follows:

Pursuant to the Principle Decision, the financial thresholds required to be met prior to an IPO will be applied at a reduced level for companies meeting one of the following criteria:

1. Companies that have generated at least 75% of their revenues in each of the last two years from sales in the renewable energy, petrochemical, defence industry, or agriculture sectors.

2. Companies that are certified by a public authority as having an innovative and scalable business model that supports the green and digital transformation and produces high value-added outputs based on advanced technology, and that satisfy at least two of the following conditions:

(i) having commenced or completed a publicly funded R&D project within the last five years.

(ii) having been accepted to and operating within a Technology Development Zone designated by the Ministry of Industry and Technology.

(iii) having a Ministry-approved and active R&D Center within the scope of Law numbered 5746.

(iv) holding a valid patent granted by the Turkish Patent and Trademark Office within the last five years.

(v) having benefited from R&D, UR-GE, or Innovation Supports provided by KOSGEB within the last five years.

Within the scope of the Principle Decision, the reduced financial criteria applicable to such based on their financial statements for the last two years, are as follows:

3. Market Capitalization Threshold Increased under the Shares Held Ready for Sale Mechanism

Pursuant to Article 9 of the Communiqué on Shares numbered VII-128.1, where the market capitalization calculated based on the offering price of the shares to be offered to the public for the first time (excluding any over-allotment) is below TRY 950,000,000 as of 2026, shares corresponding to 25% of the nominal value of the shares to be offered must, prior to the approval of the prospectus relating to the public offering, be held ready for sale, with the shareholders’ pre-emptive rights fully restricted.

4. Market Capitalization Threshold Increased under the Intermediary Firm Underwriting Mechanism

Pursuant to Article 5 of the Communiqué on Shares numbered VII-128.1, where the market capitalization calculated based on the offering price of the shares to be offered to the public for the first time (excluding any over-allotment) is, as of 2026:

(i) below TRY 750,000,000, intermediary institutions are required to undertake to purchase all unsold shares at the offering price; or

(ii) between TRY 750,000,000 and TRY 1,500,000,000, intermediary institutions are required to undertake to purchase all unsold shares up to TRY 750,000,000, and 50% of the portion exceeding this amount, at the offering price by way of an underwriting commitment in favour of the company.

For more information and support, you can contact us.

1. Minimum Capital Requirement for Transition to the Authorized Capital System Increased

Pursuant to the CMB Decision, in accordance with Article 5 of the Communiqué on the Authorized Capital System numbered II-18.1, the minimum capital amount required for companies transitioning to the authorized capital system has been set at TRY 200,000,000 for 2026.

2. Financial Criteria Regarding Total Assets and Net Sales Revenue Increased

Pursuant to the CMB Decision, the thresholds for total assets and net sales revenue have been increased for companies conducting an IPO, as well as for companies falling within the scope of the Capital Markets Board’s principle decision numbered i-SPK.128.22 (dated 28 March 2024 and numbered 18/505) (“Principle Decision”) regarding the reduction of the amounts required to be met as preconditions prior to an IPO.

For IPO applications to be submitted in 2026, the relevant financial statement figures will be assessed based on the purchasing power as of 31 December 2024 for the 2024 financial statements and as of 31 December 2025 for the 2025 financial statements.

Under the CMB Decision, the criteria that IPO companies are required to meet, based on their financial statements for the last two years audited by a special independent audit, are as follows:

| Financial Criteria (TRY) | 2024 | 2025 |

| Total Assets | 2,400,000,000 | 3,600,000,000 |

| Net Sales Revenue | 1,200,000,000 | 1.800,000,000 |

Pursuant to the Principle Decision, the financial thresholds required to be met prior to an IPO will be applied at a reduced level for companies meeting one of the following criteria:

1. Companies that have generated at least 75% of their revenues in each of the last two years from sales in the renewable energy, petrochemical, defence industry, or agriculture sectors.

2. Companies that are certified by a public authority as having an innovative and scalable business model that supports the green and digital transformation and produces high value-added outputs based on advanced technology, and that satisfy at least two of the following conditions:

(i) having commenced or completed a publicly funded R&D project within the last five years.

(ii) having been accepted to and operating within a Technology Development Zone designated by the Ministry of Industry and Technology.

(iii) having a Ministry-approved and active R&D Center within the scope of Law numbered 5746.

(iv) holding a valid patent granted by the Turkish Patent and Trademark Office within the last five years.

(v) having benefited from R&D, UR-GE, or Innovation Supports provided by KOSGEB within the last five years.

Within the scope of the Principle Decision, the reduced financial criteria applicable to such based on their financial statements for the last two years, are as follows:

| Financial Criteria (TRY) | 2024 | 2025 |

| Total Assets | 1,200,000,000 | 1,800,000,000 |

| Net Sales Revenue | 600,000,000 | 900,000,000 |

3. Market Capitalization Threshold Increased under the Shares Held Ready for Sale Mechanism

Pursuant to Article 9 of the Communiqué on Shares numbered VII-128.1, where the market capitalization calculated based on the offering price of the shares to be offered to the public for the first time (excluding any over-allotment) is below TRY 950,000,000 as of 2026, shares corresponding to 25% of the nominal value of the shares to be offered must, prior to the approval of the prospectus relating to the public offering, be held ready for sale, with the shareholders’ pre-emptive rights fully restricted.

4. Market Capitalization Threshold Increased under the Intermediary Firm Underwriting Mechanism

Pursuant to Article 5 of the Communiqué on Shares numbered VII-128.1, where the market capitalization calculated based on the offering price of the shares to be offered to the public for the first time (excluding any over-allotment) is, as of 2026:

(i) below TRY 750,000,000, intermediary institutions are required to undertake to purchase all unsold shares at the offering price; or

(ii) between TRY 750,000,000 and TRY 1,500,000,000, intermediary institutions are required to undertake to purchase all unsold shares up to TRY 750,000,000, and 50% of the portion exceeding this amount, at the offering price by way of an underwriting commitment in favour of the company.

For more information and support, you can contact us.

Download PDF

Download PDF

e.copur@lbfpartners.com

e.copur@lbfpartners.com